Why Every Home Purchaser Requirements a Reliable Home Loan Calculator for Financial Clarity

Why Every Home Purchaser Requirements a Reliable Home Loan Calculator for Financial Clarity

Blog Article

Smart Financing Calculator Option: Simplifying Your Financial Calculations

In the realm of economic administration, effectiveness and accuracy are critical. Think of a tool that not only streamlines intricate financing computations but also supplies real-time insights into your monetary commitments. The clever financing calculator solution is created to enhance your economic computations, providing a seamless way to evaluate and intend your finances. By harnessing the power of automation and progressed algorithms, this device exceeds mere number crunching, revolutionizing the means you come close to financial preparation. Whether you are a skilled financier or a newbie debtor, this innovative option assures to redefine your financial decision-making procedure.

Benefits of Smart Finance Calculator

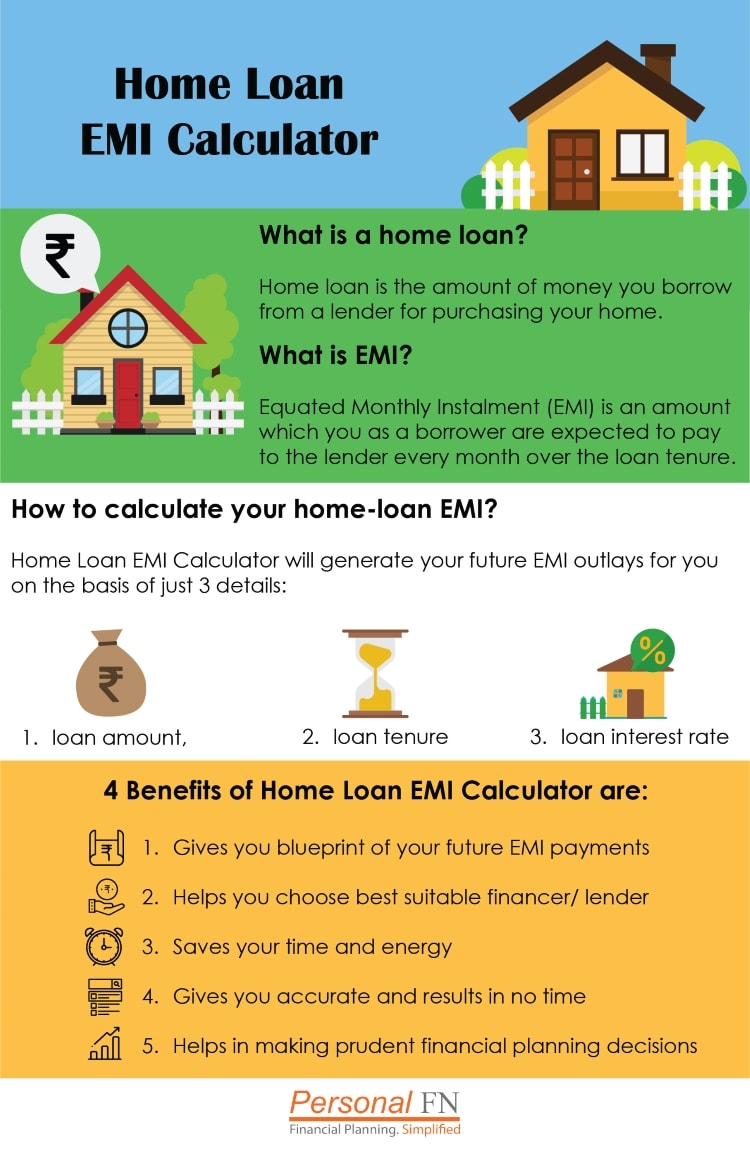

When examining financial options, the benefits of using a clever funding calculator come to be apparent in promoting notified decision-making. By inputting variables such as loan quantity, rate of interest rate, and term length, people can examine numerous situations to choose the most affordable choice tailored to their monetary scenario.

Furthermore, smart lending calculators use transparency by damaging down the complete expense of loaning, consisting of rate of interest payments and any type of added costs. This transparency equips customers to recognize the economic ramifications of securing a loan, allowing them to make audio monetary choices. Additionally, these tools can conserve time by providing instantaneous computations, eliminating the demand for hand-operated calculations or intricate spreadsheets.

Functions of the Device

The tool includes a straightforward user interface developed to streamline the process of examining and inputting loan information efficiently. Users can easily input variables such as car loan quantity, passion rate, and funding term, enabling for quick computations of monthly payments and complete passion over the funding term. The tool additionally provides the versatility to readjust these variables to see exactly how modifications affect the total funding terms, equipping users to make enlightened economic decisions.

In addition, the clever financing calculator provides a break down of each month-to-month payment, showing the portion that goes towards the major quantity and the rate of interest. This feature helps individuals envision just how their payments add to settling the car loan over time. Individuals can create comprehensive amortization routines, which describe the settlement schedule and passion paid each month, aiding in long-term financial planning.

Just How to Utilize the Calculator

In browsing the car loan calculator successfully, users can quickly leverage the user-friendly user interface to input crucial variables and generate valuable economic understandings. To begin utilizing the calculator, individuals should first input the lending quantity they are thinking about. This is commonly the total quantity of cash obtained from a lending institution. Next off, users require to enter the financing term, which describes the duration over which the lending will be repaid. Following this, the rate of interest have to be inputted, as this considerably impacts the general expense of the lending. Individuals can likewise define the repayment regularity, whether it's monthly, quarterly, or every year, to align with their monetary planning. As soon as all needed areas are finished, pushing the 'Determine' button will quickly process the details and offer crucial details such as the regular monthly payment amount, total interest payable, and total financing price. By complying with these click here for more info straightforward actions, customers can successfully utilize the finance calculator to make enlightened monetary decisions.

Benefits of Automated Computations

Automated calculations enhance monetary processes by swiftly and properly calculating complicated numbers. Hands-on calculations are vulnerable to mistakes, which can have significant ramifications for monetary decisions.

In addition, automated calculations save time and increase performance. Complex economic estimations that would usually take a significant amount of time to complete by hand can be performed in a fraction of the time with automated devices. This enables monetary experts to focus on assessing the results and making informed decisions as opposed to investing hours on calculation.

This uniformity is crucial for comparing different financial scenarios and making sound monetary selections based on accurate information. home loan calculator. Generally, the benefits of automated calculations in improving financial procedures are undeniable, using enhanced precision, efficiency, and consistency in complex monetary calculations.

Enhancing Financial Planning

Enhancing financial planning entails leveraging advanced devices and strategies to enhance fiscal decision-making procedures. By making use of innovative economic planning software program and calculators, organizations and individuals can acquire deeper insights right into their economic health and wellness, established realistic objectives, and develop workable strategies to attain them. These devices can examine various monetary scenarios, task future outcomes, and provide recommendations for efficient wealth administration and risk mitigation.

Additionally, improving financial planning incorporates incorporating automation and synthetic knowledge right into the procedure. Automation can streamline routine economic tasks, such as budgeting, cost tracking, and financial investment monitoring, releasing up time for strategic decision-making and evaluation. AI-powered tools can use personalized monetary suggestions, identify patterns, and recommend optimal financial investment opportunities based on specific risk profiles and monetary objectives.

In addition, partnership with financial consultants and experts can boost financial preparation by supplying useful insights, market knowledge, and tailored techniques customized to specific economic objectives and situations. By integrating advanced tools, automation, AI, and specialist guidance, individuals and companies can raise their financial planning abilities and make educated decisions to safeguard their monetary future.

Conclusion

In conclusion, the wise funding calculator solution offers countless advantages and functions for streamlining economic computations - home loan calculator. By utilizing this device, users can conveniently determine lending settlements, rates of interest, and settlement schedules with precision and effectiveness. The automated estimations provided by the calculator improve monetary preparation and decision-making processes, eventually causing much better monetary monitoring and informed selections

The wise loan calculator option is created to improve your financial that site estimations, using a smooth way to examine and intend your finances. Generally, the benefits of automated calculations in enhancing monetary processes are indisputable, supplying boosted precision, effectiveness, and consistency in intricate economic computations.

By making use of innovative monetary planning software program and people, calculators and businesses can gain deeper insights right into their economic health and wellness, established realistic objectives, and develop actionable plans to this article achieve them. AI-powered devices can offer customized financial recommendations, identify patterns, and recommend optimum financial investment possibilities based on private danger accounts and financial purposes.

Report this page